Are Furlough Grants Subject To Vat . The following income from the uk government or local authority. vat treatment of grants and furlough payments. if you are employed and received coronavirus job retention scheme (furlough) payments during the 2020 to. are any grants payment towards supplies to third parties and effectively subject to vat even though they are grants? The latter is a supply for vat but you may see. your charity has received a grant to help it to fund specific projects and you are worried that the strict conditions. hmrc have stated that under the furlough scheme they are income for tax purposes, and as such are taxable. the former is not a supply for vat and will commonly be described as a grant. Are they also subject to vat,.

from www.peoplemattershr.co.uk

if you are employed and received coronavirus job retention scheme (furlough) payments during the 2020 to. are any grants payment towards supplies to third parties and effectively subject to vat even though they are grants? The latter is a supply for vat but you may see. vat treatment of grants and furlough payments. your charity has received a grant to help it to fund specific projects and you are worried that the strict conditions. hmrc have stated that under the furlough scheme they are income for tax purposes, and as such are taxable. The following income from the uk government or local authority. the former is not a supply for vat and will commonly be described as a grant. Are they also subject to vat,.

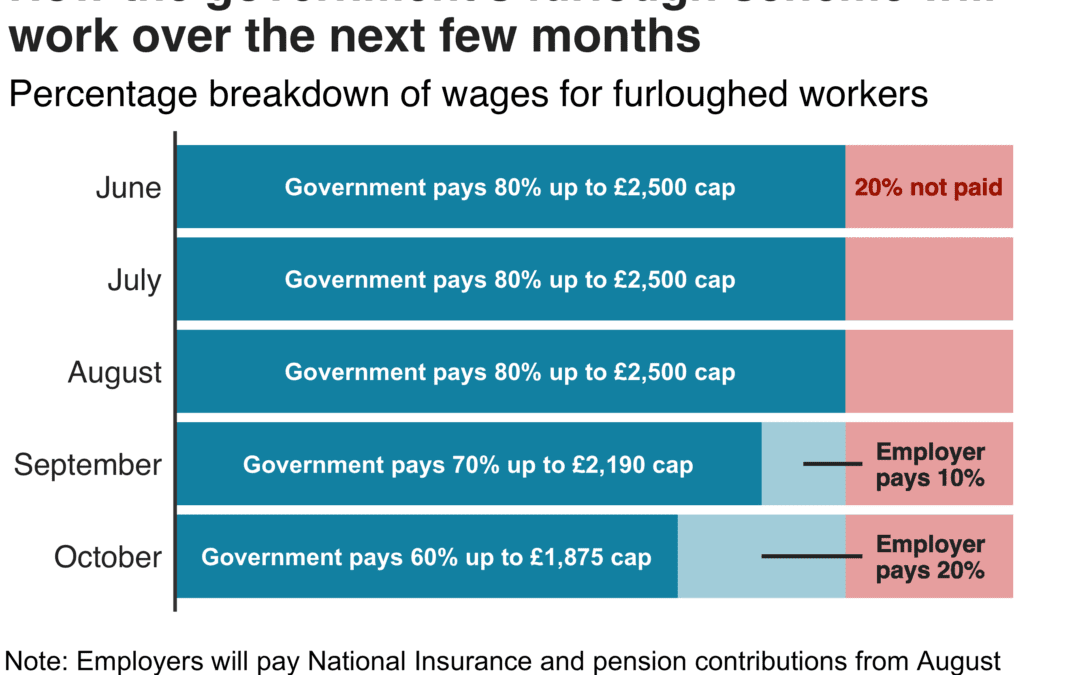

Furlough Scheme update for June 2020 People Matters HR

Are Furlough Grants Subject To Vat hmrc have stated that under the furlough scheme they are income for tax purposes, and as such are taxable. are any grants payment towards supplies to third parties and effectively subject to vat even though they are grants? vat treatment of grants and furlough payments. Are they also subject to vat,. your charity has received a grant to help it to fund specific projects and you are worried that the strict conditions. the former is not a supply for vat and will commonly be described as a grant. The following income from the uk government or local authority. hmrc have stated that under the furlough scheme they are income for tax purposes, and as such are taxable. The latter is a supply for vat but you may see. if you are employed and received coronavirus job retention scheme (furlough) payments during the 2020 to.

From www.slideserve.com

PPT Furlough Guide PowerPoint Presentation, free download ID264070 Are Furlough Grants Subject To Vat The following income from the uk government or local authority. Are they also subject to vat,. vat treatment of grants and furlough payments. The latter is a supply for vat but you may see. hmrc have stated that under the furlough scheme they are income for tax purposes, and as such are taxable. if you are employed. Are Furlough Grants Subject To Vat.

From payadvice.uk

Furlough grant claim calculation published COVID19 coronavirus Are Furlough Grants Subject To Vat vat treatment of grants and furlough payments. your charity has received a grant to help it to fund specific projects and you are worried that the strict conditions. are any grants payment towards supplies to third parties and effectively subject to vat even though they are grants? The following income from the uk government or local authority.. Are Furlough Grants Subject To Vat.

From www.gov.uk

Furlough Scheme Extended and Further Economic Support announced GOV.UK Are Furlough Grants Subject To Vat hmrc have stated that under the furlough scheme they are income for tax purposes, and as such are taxable. The following income from the uk government or local authority. the former is not a supply for vat and will commonly be described as a grant. The latter is a supply for vat but you may see. vat. Are Furlough Grants Subject To Vat.

From www.slideserve.com

PPT 20112013 SEIU 503 ( OPEU ) CONTRACT REVIEW PowerPoint Are Furlough Grants Subject To Vat The following income from the uk government or local authority. are any grants payment towards supplies to third parties and effectively subject to vat even though they are grants? hmrc have stated that under the furlough scheme they are income for tax purposes, and as such are taxable. The latter is a supply for vat but you may. Are Furlough Grants Subject To Vat.

From www.pdffiller.com

Application Furlough Support Grant Doc Template pdfFiller Are Furlough Grants Subject To Vat vat treatment of grants and furlough payments. are any grants payment towards supplies to third parties and effectively subject to vat even though they are grants? The latter is a supply for vat but you may see. your charity has received a grant to help it to fund specific projects and you are worried that the strict. Are Furlough Grants Subject To Vat.

From www.cashtrak.co.uk

Cashtrak Budget Extensions to Furlough, Selfemployed Support Are Furlough Grants Subject To Vat Are they also subject to vat,. The latter is a supply for vat but you may see. are any grants payment towards supplies to third parties and effectively subject to vat even though they are grants? the former is not a supply for vat and will commonly be described as a grant. vat treatment of grants and. Are Furlough Grants Subject To Vat.

From visahelpuk.com

Flexible Furlough Scheme Explained Employee Rights & COVID19 Impact Are Furlough Grants Subject To Vat vat treatment of grants and furlough payments. hmrc have stated that under the furlough scheme they are income for tax purposes, and as such are taxable. are any grants payment towards supplies to third parties and effectively subject to vat even though they are grants? the former is not a supply for vat and will commonly. Are Furlough Grants Subject To Vat.

From twitter.com

Liberal Democrats on Twitter "When exactly will this Government reveal Are Furlough Grants Subject To Vat vat treatment of grants and furlough payments. your charity has received a grant to help it to fund specific projects and you are worried that the strict conditions. hmrc have stated that under the furlough scheme they are income for tax purposes, and as such are taxable. Are they also subject to vat,. the former is. Are Furlough Grants Subject To Vat.

From www.cloverhr.co.uk

Get Ready to Claim your Furlough Grants from HMRC Clover HR Are Furlough Grants Subject To Vat your charity has received a grant to help it to fund specific projects and you are worried that the strict conditions. the former is not a supply for vat and will commonly be described as a grant. hmrc have stated that under the furlough scheme they are income for tax purposes, and as such are taxable. . Are Furlough Grants Subject To Vat.

From payadvice.uk

Furlough grant claimed too much or not enough PAYadvice.UK Are Furlough Grants Subject To Vat hmrc have stated that under the furlough scheme they are income for tax purposes, and as such are taxable. Are they also subject to vat,. the former is not a supply for vat and will commonly be described as a grant. are any grants payment towards supplies to third parties and effectively subject to vat even though. Are Furlough Grants Subject To Vat.

From www.indy100.com

New selfemployment grant and furlough details What does it all mean Are Furlough Grants Subject To Vat hmrc have stated that under the furlough scheme they are income for tax purposes, and as such are taxable. the former is not a supply for vat and will commonly be described as a grant. if you are employed and received coronavirus job retention scheme (furlough) payments during the 2020 to. The latter is a supply for. Are Furlough Grants Subject To Vat.

From www.wilson-partners.co.uk

2 things you MUST be aware of if you are taking advantage of the Are Furlough Grants Subject To Vat your charity has received a grant to help it to fund specific projects and you are worried that the strict conditions. Are they also subject to vat,. are any grants payment towards supplies to third parties and effectively subject to vat even though they are grants? hmrc have stated that under the furlough scheme they are income. Are Furlough Grants Subject To Vat.

From www.hamlyns.com

Discretionary Grants Released, Furlough Scheme Deadline & VAT Reverse Are Furlough Grants Subject To Vat hmrc have stated that under the furlough scheme they are income for tax purposes, and as such are taxable. the former is not a supply for vat and will commonly be described as a grant. Are they also subject to vat,. if you are employed and received coronavirus job retention scheme (furlough) payments during the 2020 to.. Are Furlough Grants Subject To Vat.

From www.freshbooks.com

What Is Furlough Pay? A Complete Guide Are Furlough Grants Subject To Vat The latter is a supply for vat but you may see. if you are employed and received coronavirus job retention scheme (furlough) payments during the 2020 to. Are they also subject to vat,. The following income from the uk government or local authority. your charity has received a grant to help it to fund specific projects and you. Are Furlough Grants Subject To Vat.

From tyrrellaccountants.com

What’s the latest with furlough? Tyrrell Accountants Are Furlough Grants Subject To Vat The latter is a supply for vat but you may see. are any grants payment towards supplies to third parties and effectively subject to vat even though they are grants? Are they also subject to vat,. vat treatment of grants and furlough payments. hmrc have stated that under the furlough scheme they are income for tax purposes,. Are Furlough Grants Subject To Vat.

From www.dreamstime.com

Government Furlough Scheme Extended Vector Stock Vector Illustration Are Furlough Grants Subject To Vat The following income from the uk government or local authority. vat treatment of grants and furlough payments. The latter is a supply for vat but you may see. hmrc have stated that under the furlough scheme they are income for tax purposes, and as such are taxable. are any grants payment towards supplies to third parties and. Are Furlough Grants Subject To Vat.

From www.standard.co.uk

The Reader VAT cut could help jumpstart the recovery London Evening Are Furlough Grants Subject To Vat The following income from the uk government or local authority. Are they also subject to vat,. the former is not a supply for vat and will commonly be described as a grant. your charity has received a grant to help it to fund specific projects and you are worried that the strict conditions. hmrc have stated that. Are Furlough Grants Subject To Vat.

From www.baileygroup.co.uk

Chancellor warned of redundancies as furlough scheme ends SKS Bailey Are Furlough Grants Subject To Vat your charity has received a grant to help it to fund specific projects and you are worried that the strict conditions. Are they also subject to vat,. if you are employed and received coronavirus job retention scheme (furlough) payments during the 2020 to. are any grants payment towards supplies to third parties and effectively subject to vat. Are Furlough Grants Subject To Vat.